Maximizing credit card rewards per dollar spent is what it’s all about for some travelers, including yours truly. The good news is that each of the major transferable point programs offers combinations of credit cards that help to maximize every dollar that you spend.

It’s going to be interesting to see if Bilt Rewards offers a second product in addition to its Bilt Rewards Card. Could it be another personal credit card for your everyday spending? A business credit card to complement its personal card? Who knows? But I trust that this is an area where their team is looking to gain market share. With that said, let’s hop into the best credit card combos for maximizing credit card rewards.

For more Points With Q articles delivered to your inbox, sign up for my travel newsletter.

American Express Membership Rewards

Amex Gold Card + Amex EveryDay Card

- Annual Fees: $250 (Amex Gold Card) + $0 (Amex EveryDay Card)

- Earning Structure: 4X points at restaurants and U.S. grocery stores (Amex Gold Card, 3X points on airfare (Amex Gold Card), 2X points on U.S. grocery stores (Amex EveryDay Card), 20% bonus points when you make 20+ transactions in a billing cycle

Amex Business Gold + Amex Blue Business Plus

- Annual Fees: $250 (Amex Busines Gold Card) + $0 (Amex Blue Business Plus)

- Earning Structure: 4X points on your top two spending categories that include airfare, U.S. advertising, U.S. computer hardware, software, and cloud computing purchases, U.S. gas stations, U.S. restaurants, including takeout and delivery, and U.S. shipping services; 2X points on all purchases (Amex Blue Business Plus)

Capital One Miles

Capital One Venture X + Capital One SavorOne

- Annual Fees: $395 (Capital One Venture X) + $0 (Capital One SavorOne)

- Earning Structure: 10X miles on hotels & rental cars booked through Capital One Travel, 5X Miles on flights booked through Capital One Travel, 2X Miles on all other purchases (Capital One Venture X); 3X miles on dining, entertainment, streaming services, and at grocery stores (Capital One SavorOne)

Chase Ultimate Rewards

Chase Sapphire Preferred + Chase Freedom Unlimited

- Annual Fees: $95 (Chase Sapphire Preferred) + $0 (Chase Freedom Unlimited)

- Earning Structure: 2X points on travel, 3X points on dining, including eligible delivery services, takeout and dining out, online grocery purchases, select streaming services (Chase Sapphire Preferred), 1.5X points on all purchases (Chase Freedom Unlimited)

Ink Business Preferred + Ink Business Unlimited

- Annual Fees: $95 (Ink Business Preferred) + $0 (Ink Business Unlimited)

- Earning Structure: 3X points on the first $150,000 spent in combined purchases on shipping, advertising purchases made with social media sites and search engines, internet, cable and phone services, and travel (Ink Business Preferred); 1.5X points on all purchases with the Ink Business Unlimited

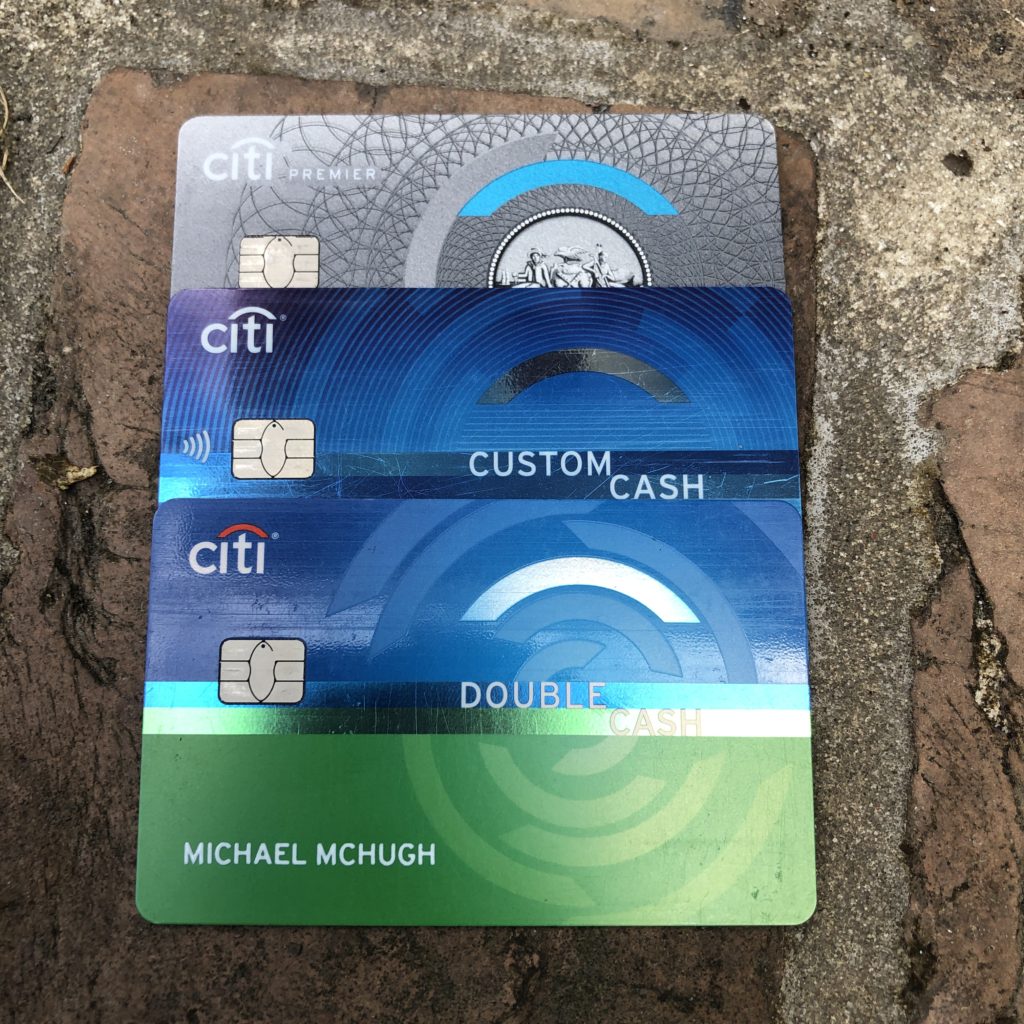

Citi ThankYou Rewards

Citi Premier Card + Citi Double Cash

- Annual Fees: $95 (Citi Premier Card) + $0 (Citi Double Cash)

- Earning Structure: 3X points on restaurants, supermarkets, gas stations, air travel, and hotels (Citi Premier Card); 2X points on all purchases (Citi Double Cash)

Conclusion on Maximizing Credit Card Rewards

The combos for maximizing credit card rewards include cards offered Amex Membership Rewards, Capital One Miles, Chase Ultimate Rewards, and Citi ThankYou Rewards. You likely can’t go wrong with any of these combos.

How are you looking at maximizing credit card rewards? Please let me know in the comments or by sending me an email on my contact page.

Disclaimer: If you click and/or sign up for a credit card through certain links on this site or any of my related social media platforms, I may make a commission from that click-through. The editorial content on this page and the user comments are not provided by any of the companies mentioned and have not been reviewed, approved, or otherwise endorsed by any of these entities. The opinions expressed here are mine alone.