Chase, like its competitors, has credit cards like the Chase Freedom that earn points in a rewards program that can be used for travel.

The Chase Ultimate Rewards program is one of the 5 transferable point programs. The other programs are American Express Membership Rewards, Citi ThankYou Rewards, and Marriott.

Marriott’s program is different because you can transfer hotel points, instead of credit card points, to an airline.

I’ve continually found value in the Ultimate Rewards program by leveraging its airline partners like British Airways, Iberia, Singapore Airlines, Southwest, and United.

Chase Freedom Details

The Chase Freedom is an ideal beginner rewards credit card for two main reasons. The first reason is because the card doesn’t have an annual fee. You get the ability to earn cash back that can converted into points without having to pay a fee.

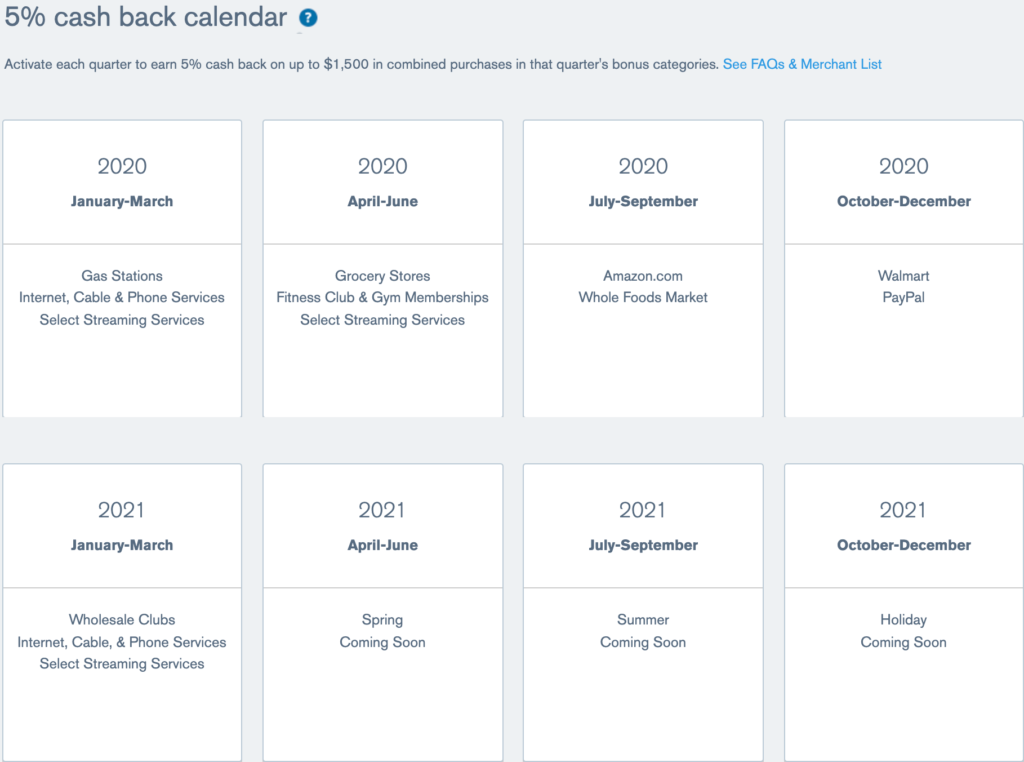

The second reason is because of the earning structure. The card earns 5% cash back, up to $1,500 in spend per quarter, in rotating quarterly bonuses.

Current Offer

Chase is currently offering a $150 sign up bonus after spending $500 in the first 3 months after you open a Chase Freedom credit card.

Spending $500 in the first 3 months is a low spending requirement to earn a solid $150 sign up bonus. Many credit cards require you to spend between $1,000-$5,000 in the same time period to earn a sign up bonus.

How to Earn Chase Points

The Chase Freedom earns 5% cashback in rotating bonus categories on up to $1,500 in spend. Before the start of the new quarter, Chase announces which categories earn 5% cashback. For Q1 2021, cardmembers earn 5% cashback on Wholesale Clubs, Internet, Cable, & Phone Services, Select Streaming Services purchases.

The key with the Chase Freedom is to align your spend with the quarterly bonus. 5% is generally the highest earn rate you will see, cash back or otherwise, so it’s ideal if you can max out the $1,500 spend.

How to Redeem Chase Points

The beauty of the Ultimate Rewards program is the ability to combine your points. While the Chase Freedom is a cash back credit card, you can convert your cash back into Ultimate Rewards points if you have an Ultimate Rewards earning card.

Simply transfer your Chase Freedom cash back to one of the Ultimate Rewards card below, and your cash back turns into Ultimate Rewards points.

Transferring your Chase points to one of its airline partners will yield the most value for your points, compared to redeeming them for cash back. With that said, here a few examples of how you can leverage the Ultimate Rewards program.

If you’re looking to fly American Airlines, you can transfer your points to British Airways or Iberia and book an American Airlines flight.

Does a United flight work better for you? Transfer your points to United Airlines and book a flight directly on the United website.

Is Delta the only airline flying to your destination? Transfer your points to Virgin Atlantic and book a Delta flight.

Conclusion on the Chase Freedom

Chase is a great program and the Chase Freedom is a credit card that can add value to your rewards portfolio.

While the card has limitations in the amount of points you can earn per quarter ($1,500 * 5% = 7,500 points) and the categories that earn 5%, it’s a card that any traveler should consider.

Do you have the Chase Freedom credit card? How do you recommend maximizing your spend in the bonus categories? Please let me know in the comments below or by sending me an email on my contact page.

Disclaimer: If you click and/or sign up for a credit card through certain links on this site or any of my related social media platforms, I may make a commission from that click-through. The editorial content on this page and the user comments are not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are mine alone.